BLOGS

12 Aug 2025

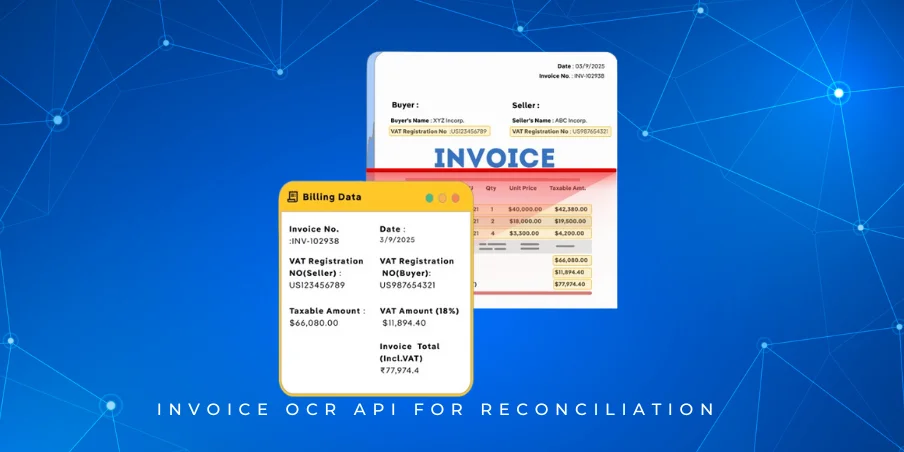

Invoice OCR API for Reconciliation: Cutting Down Manual Errors

The Challenge of Invoice Reconciliation

Invoice OCR API for Reconciliation plays a vital role in addressing one of the most persistent challenges in business finance—accurate and timely invoice reconciliation. Invoice reconciliation is critical for maintaining financial health, ensuring that payments are made correctly and on time, and that vendors are satisfied. However, manual reconciliation processes are often prone to errors such as data entry mistakes, mismatched amounts, and overlooked discrepancies. These errors can lead to delayed payments, increased audit risks, and strained vendor relationships, ultimately impacting cash flow and operational efficiency.

Manual invoice reconciliation is not only time-consuming but also vulnerable to human error. The complexity increases when dealing with high volumes of invoices and diverse invoice formats, making it difficult to standardize the process. Invoice OCR API for Reconciliation automates data extraction from invoices, reducing errors and speeding up processing times. By accurately capturing key data points like invoice numbers, amounts, and dates, OCR technology helps businesses avoid costly mistakes and improves the overall efficiency of their accounts payable workflows.

Adopting an Invoice OCR API for Reconciliation also enhances transparency and audit readiness by providing a digital trail of reconciled invoices. Companies using advanced APIs like those offered by AZAPI.ai benefit from faster reconciliation cycles, better compliance, and stronger vendor relationships. As businesses continue to scale, the importance of integrating intelligent OCR solutions to streamline invoice reconciliation processes will only grow.

How Manual Invoice Reconciliation Fails Businesses

Manual invoice reconciliation often becomes a bottleneck in business operations due to its labor-intensive nature. The process requires painstaking data entry and cross-checking of invoice details against purchase orders and payment records. This time-consuming effort slows down the entire accounts payable cycle, delaying payments and affecting vendor trust.

Human errors are another major pitfall of manual reconciliation. Typos, missed line items, and duplicate entries frequently occur, leading to discrepancies that require further investigation and correction. Such mistakes not only consume valuable time but also increase the risk of financial inaccuracies and audit issues.

Moreover, businesses face difficulties handling the wide variety of invoice formats and unstructured data they receive from different vendors. Each invoice may have unique layouts, fonts, and data placements, making it challenging for manual processes to maintain consistency and accuracy. This diversity often results in lost information or incorrect data capture.

Invoice OCR API for Reconciliation, such as solutions from AZAPI.ai, addresses these challenges by automating data extraction, minimizing errors, and handling multiple invoice formats with ease. This automation frees up teams to focus on exception management and strategic tasks, transforming invoice reconciliation from a headache into a competitive advantage.

Enter Invoice OCR API: Automating the Process

Invoice OCR API for Reconciliation revolutionizes the way businesses handle invoice processing by automating the extraction of critical data from scanned or digital invoices. Instead of relying on manual entry, which is slow and error-prone, this technology uses optical character recognition (OCR) combined with artificial intelligence to read and interpret invoice content accurately.

The core function of an Invoice OCR API is to identify and extract key fields such as invoice number, date, vendor details, line items, totals, and taxes, regardless of the invoice’s format or layout. This capability is crucial for reconciliation, where precise matching of invoice data against purchase orders and payments is required.

AI-powered Invoice OCR engines, like those provided by AZAPI.ai, can intelligently adapt to multiple invoice templates and unstructured formats. This flexibility means businesses don’t need to standardize incoming invoices, saving time and reducing the friction that often delays reconciliation cycles. The result is faster, more reliable invoice processing that integrates seamlessly into existing financial systems.

How Invoice OCR API Cuts Down Manual Errors

Manual invoice reconciliation has long been a time-consuming and error-prone process that can slow down business operations and cause costly delays. Enter the Invoice OCR API for Reconciliation, a powerful technology designed to automate and streamline the entire invoice data extraction process. By leveraging advanced Optical Character Recognition (OCR) capabilities, this API reads invoice documents—whether scanned copies or digital PDFs—and accurately extracts critical fields such as invoice number, date, vendor details, line items, and totals.

One of the main advantages of using an Invoice OCR API is the drastic reduction in human errors commonly introduced during manual data entry. Typos, missed line items, duplicated entries, and inconsistent formatting often result in reconciliation mismatches, leading to payment delays and audit complications. With automated, AI-driven data capture, the extracted information is consistent and standardized, significantly improving the accuracy of invoice matching against purchase orders, contracts, and payment records.

Moreover, the Invoice OCR API for Reconciliation can handle a wide variety of invoice formats and layouts, thanks to machine learning models trained on diverse datasets. This adaptability means businesses no longer need custom templates for every vendor invoice type, further reducing the manual workload and speeding up processing.

Providers like AZAPI.ai offer robust Invoice OCR solutions that include real-time validation and error detection features. These systems flag incomplete or suspicious data points immediately as invoices are processed, allowing finance teams to resolve issues proactively instead of discovering them during time-intensive audits or payment cycles.

By automating data extraction and incorporating intelligent error checking, businesses can enhance operational efficiency, shorten invoice processing times, and improve vendor relationships through timely payments. Ultimately, integrating an Invoice OCR API into your reconciliation workflow not only cuts down manual errors but also provides a scalable foundation for more advanced financial automation and analytics initiatives.

Real-World Benefits for Finance Teams

Implementing an Invoice OCR API for Reconciliation brings tangible, impactful benefits to finance teams, transforming how they manage invoices and payments. One of the most immediate advantages is the significant acceleration of reconciliation cycles. By automating the extraction and validation of invoice data, finance teams can process large volumes of invoices in minutes instead of days, leading to faster payment approvals and improved cash flow management. This speed enables businesses to take advantage of early payment discounts and maintain stronger vendor relationships.

Data accuracy is another critical gain from using an Invoice OCR API. Manual reconciliation is prone to errors—typos, mismatched amounts, or overlooked line items often result in disputes with suppliers. Automated OCR solutions drastically reduce these errors by ensuring consistent and precise data capture from every invoice. No matter how complex the layout. This reliability minimizes costly payment disputes and builds trust between companies and their vendors.

Additionally, finance teams benefit from enhanced audit trails and compliance. Digital records generated by Invoice OCR API systems provide a clear, searchable, and tamper-proof log of all invoice processing activities. This transparency simplifies internal audits and regulatory compliance, helping businesses meet financial reporting standards with confidence.

Companies using advanced OCR platforms like AZAPI.ai enjoy these benefits while also gaining access to scalable. Customizable APIs that can integrate seamlessly with existing ERP and accounting software. This integration ensures that finance teams can leverage automation without overhauling their entire IT infrastructure.

Overall, the adoption of an Invoice OCR API empowers finance teams to work more efficiently, reduce errors. And maintain financial accuracy, all while freeing up resources to focus on higher-value strategic activities.

Implementation Considerations

Successfully adopting an Invoice OCR API for Reconciliation requires careful planning and execution to maximize its benefits while minimizing disruptions. One of the primary considerations is the seamless integration of the OCR API with existing ERP and accounting software. Many organizations operate with complex legacy systems, and the new technology must work harmoniously within these environments. To avoid creating data silos or workflow bottlenecks. Leading providers like AZAPI.ai offer flexible APIs designed for easy integration. Enabling finance teams to automate invoice processing without overhauling their current infrastructure.

Data security and privacy are critical factors when implementing an Invoice OCR API. Since invoice data often contains sensitive financial and vendor information. Businesses must ensure that the OCR solution complies with industry standards and regulations such as GDPR, HIPAA. Or regional data protection laws. Encryption, secure transmission protocols, and robust access controls are essential features to look for when selecting an API provider. Guaranteeing that sensitive data is protected throughout the reconciliation process.

Another vital aspect is training staff and adjusting existing workflows to accommodate the new technology. Transitioning from manual processes to automated systems requires change management. Including educating finance teams about how the OCR API works. What exceptions might need manual intervention, and how to interpret automated validation alerts. Clear communication and phased rollouts can help minimize resistance and ensure smooth adoption.

In summary, while the Invoice OCR API offers significant efficiency gains, success depends on thoughtful integration. Stringent security measures, and user readiness. Partnering with experienced vendors like AZAPI.ai can ease this transition. Providing expert support and customizable solutions tailored to specific business needs.

Future Trends: Beyond OCR in Reconciliation

The future of invoice reconciliation is rapidly evolving beyond traditional OCR technology. Modern Invoice OCR API solutions are increasingly integrating advanced. AI and machine learning capabilities to not only extract data but also analyze it for deeper insights. By leveraging AI-powered predictive analytics, finance teams can anticipate discrepancies. Flag potential fraud, and identify payment patterns that help optimize cash flow management.

One of the most exciting developments is the move toward fully automated reconciliation systems. These systems use intelligent exception handling to automatically resolve most mismatches. Reducing the need for manual intervention to just the most complex cases. This next-generation automation significantly speeds up reconciliation cycles and enhances accuracy. Freeing finance professionals to focus on strategic decision-making rather than routine tasks.

As these technologies mature, the role of finance teams is transforming from data entry operators to analysts and strategic partners. With tools like AZAPI.ai’s cutting-edge Invoice OCR API integrated with Artificial Intelligence and analytics. Businesses can expect more proactive financial management, better compliance tracking, and smarter vendor relationships in a digital-first environment.

Adopting these future-ready solutions today positions companies to stay competitive. Reduce operational risks, and harness the full value of their financial data.

Conclusion: Embracing Invoice OCR for Error-Free Reconciliation

The adoption of an best Invoice OCR API marks a pivotal shift in how businesses manage invoice reconciliation. By automating data extraction and validation, companies can drastically reduce manual errors, speed up reconciliation cycles. And strengthen compliance with audit requirements. This transformation not only enhances accuracy but also frees finance teams to focus on higher-value activities that drive business growth.

Leading providers like AZAPI.ai offer robust. AI-powered Invoice OCR API solutions designed to handle diverse invoice formats and real-world document challenges. Their technology ensures consistent, reliable data capture and seamless integration with existing financial systems.

For businesses seeking to reduce operational risks, improve cash flow management, and build stronger vendor relationships. Embracing automated invoice reconciliation is no longer optional — it’s essential. Now is the time to leverage Invoice OCR API technology and move toward an error-free, efficient financial future.

FAQs

Q1: What is an Invoice OCR API and how does it help in reconciliation?

Ans: An Invoice OCR API automates the extraction of data from invoices, converting scanned or digital documents into structured, machine-readable formats. This helps in reconciliation by significantly reducing manual data entry errors and speeding up invoice matching against purchase orders or payments.

Q2: How does Invoice OCR API improve the accuracy of invoice reconciliation?

Ans: By using advanced AI and machine learning, the Invoice OCR API accurately captures invoice details like vendor names, amounts, dates, and line items regardless of invoice format. This consistency eliminates typical manual mistakes such as typos or missed fields, leading to cleaner reconciliations.

Q3: Can Invoice OCR API handle multiple invoice formats and languages?

Ans: Yes, modern Invoice OCR solutions, including those offered by AZAPI.ai, are designed to handle a wide variety of invoice layouts, formats, and even multiple languages, ensuring reliable data extraction no matter how diverse the documents are.

Q4: How secure is the data processed through an Invoice OCR API?

Ans: Data security is critical, especially for sensitive financial information. Trusted providers like AZAPI.ai ensure that their Invoice OCR APIs comply with industry-standard data privacy regulations and employ encryption both at rest and in transit to protect client data.

Q5: How easy is it to integrate Invoice OCR API with existing ERP or accounting systems?

Ans: Most Invoice OCR APIs offer flexible integration options such as RESTful endpoints and SDKs, enabling seamless connection with popular ERP, accounting, or financial management software. AZAPI.ai also provides support and documentation to facilitate smooth integration and reduce deployment time.

Q6: What are the common challenges when implementing Invoice OCR for reconciliation?

Ans: Challenges include managing poor image quality, handling exceptions in automated processing, and ensuring user adoption in finance teams. Using a reliable Invoice OCR API like AZAPI.ai’s can mitigate these by offering high accuracy and customizable workflows.

Q7: How does Invoice OCR API reduce operational costs?

Ans: By automating data entry and reconciliation, businesses save on labor costs, reduce errors that cause payment delays or disputes, and improve audit readiness — resulting in significant overall operational efficiency.

Q8: What future enhancements can be expected beyond traditional Invoice OCR?

Ans: The future includes combining Invoice OCR with AI-powered predictive analytics, automated exception handling, and full end-to-end digital reconciliation workflows. Providers such as AZAPI.ai are continuously innovating to bring these advanced features to market.